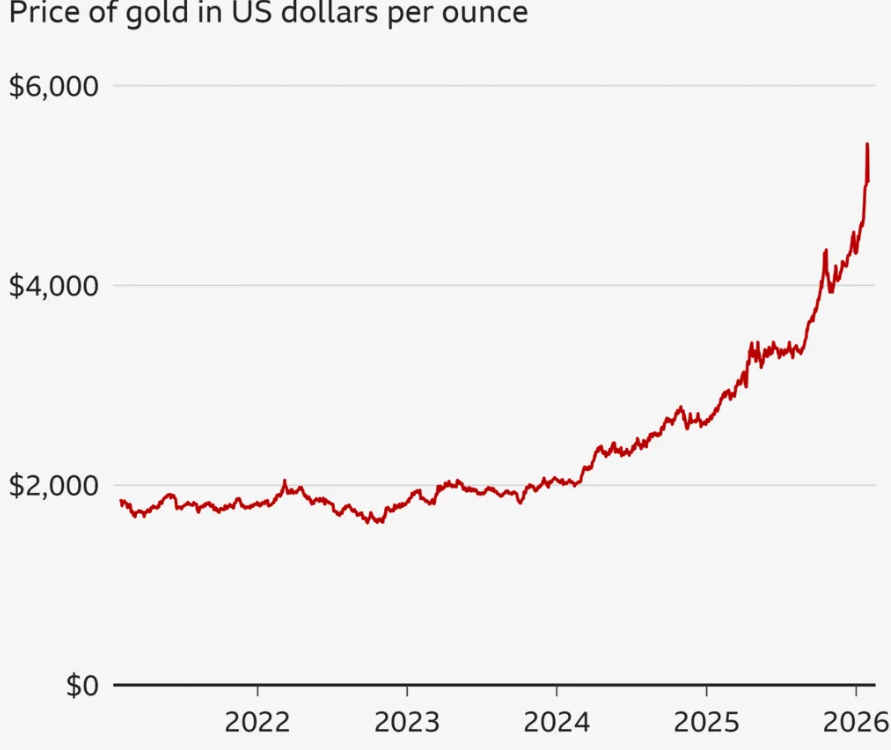

Gold prices have climbed to record highs in recent weeks, as investors flock to the safe-haven asset amid rising global political and economic uncertainty. If you want it slightly more market-focused or Google Discover–friendly, here are two quick alternatives:

Amid escalating geopolitical tensions, gold prices have surged to record highs, attracting strong safe-haven demand from investors. Gold prices have touched record levels as heightened global uncertainty drives investors toward safe-haven assets.

Gold crossed $5,000 an ounce for the first time and briefly touched $5,500, with silver and platinum also rising. Prices have since fallen on signs of US political stability but remain well above last year’s levels.

Trump-related uncertainty is reshaping global investment flows.

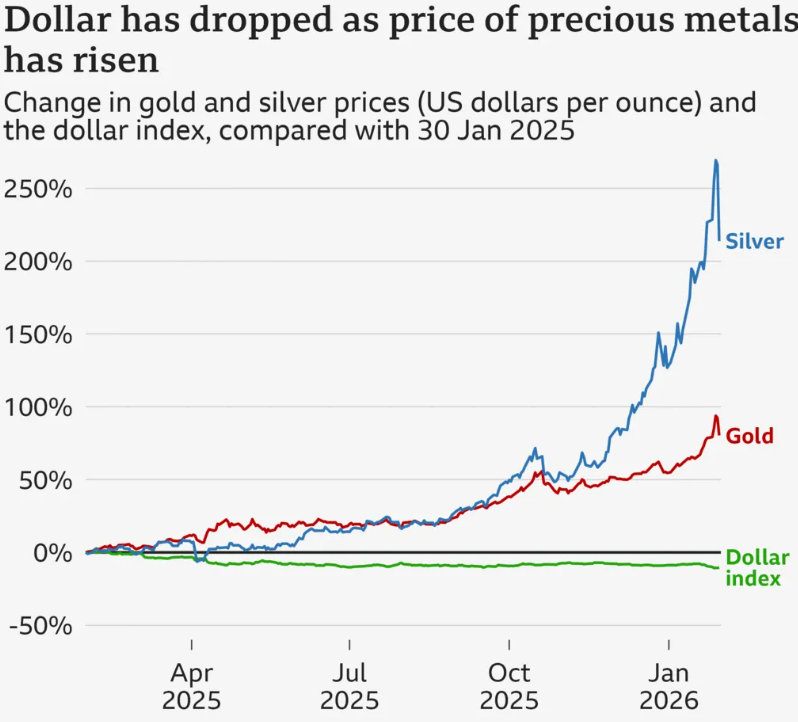

Global trade has been disrupted by tariffs imposed by US President Donald Trump, unsettling investors and boosting demand for gold. According to Emma Wall of Hargreaves Lansdown, ongoing trade uncertainty has helped fuel the gold rally. Gold and silver hit record highs in January as markets reacted to fresh tariff threats, while equities fell. Hamad Hussain of Capital Economics said gold’s safe-haven appeal has intensified amid concerns over US trade, foreign, and fiscal policies.

War fears and Greenland threats deepen global uncertainty

Wars in Ukraine and Gaza have added to global political uncertainty, while US actions involving Venezuela further pushed gold prices higher. Tensions linked to Donald Trump’s Greenland threats weakened the US dollar, driving investors toward precious metals.

“Gold thrives when the world feels unstable,” said Emma Wall, citing rising trade tensions, geopolitical flashpoints, and political uncertainty in the US as key drivers of gold’s appeal.

Central banks ramp up gold buying, boosting prices

Central bank buying has been a major driver of higher gold prices, as countries look to reduce reliance on the US dollar. According to Emma Wall, gold is increasingly being favoured as a neutral reserve asset, especially after concerns that dollar assets can be frozen during geopolitical conflicts.

Some nations, she said, took note of Russia’s dollar assets being seized following the Ukraine war, making gold a more attractive store of value. While central banks are still buying more gold than before 2022, Hamad Hussain of Capital Economics noted that demand eased slightly in 2025.

Gold demand has also been supported by China, the world’s largest buyer, as well as strong interest from Western investors and new large buyers such as Tether, whose gold purchases have reportedly rivalled those of some small countries.

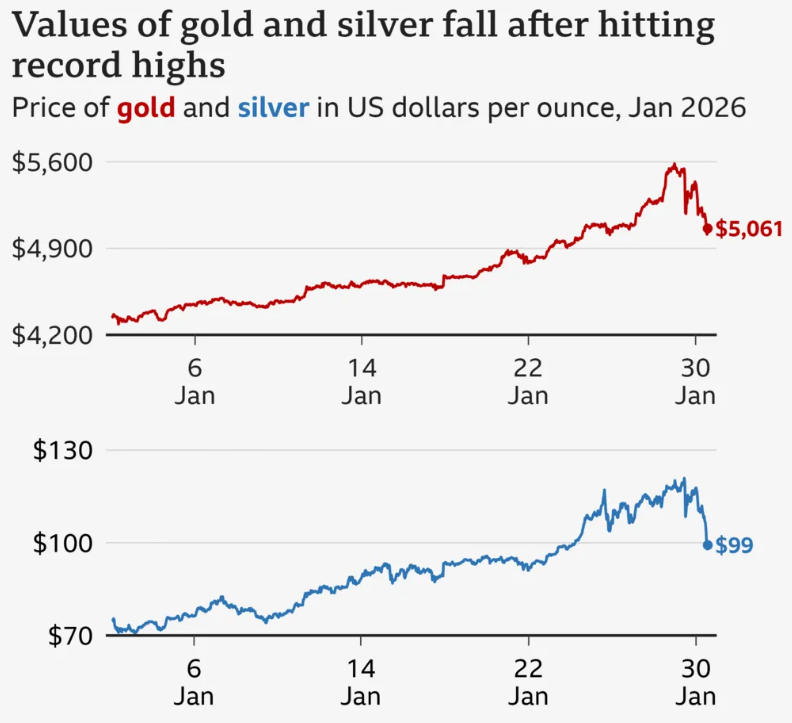

Why Have Gold and Silver Prices Fallen in Recent Days?

Gold prices had surged to record highs in recent days, partly driven by fears that Donald Trump could appoint a US Federal Reserve chief willing to cut interest rates, a move that investors worried would weaken the dollar and fuel inflation. Buying gold is often seen as a hedge against both risks.

However, gold, silver and platinum prices fell sharply after reports suggested Trump may nominate Kevin Warsh, who is viewed by markets as a more stable and predictable choice compared with other potential candidates.

Despite the recent dip, precious metal prices remain far higher than a year ago, supported by ongoing geopolitical tensions, existing and threatened US tariffs, and continuing global conflicts. These factors have kept gold and silver attractive as safe-haven assets for cautious investors.

One of gold’s strongest appeals is its limited supply. As Nicholas Frappell, global head of institutional markets at ABC Refinery, told the BBC, gold is not tied to the debt or performance of a government or company, making it a powerful portfolio diversifier during uncertain times.

Still, the latest price swings underline that gold can fall almost as quickly as it rises, reminding investors that even safe-haven assets are not immune to volatility.